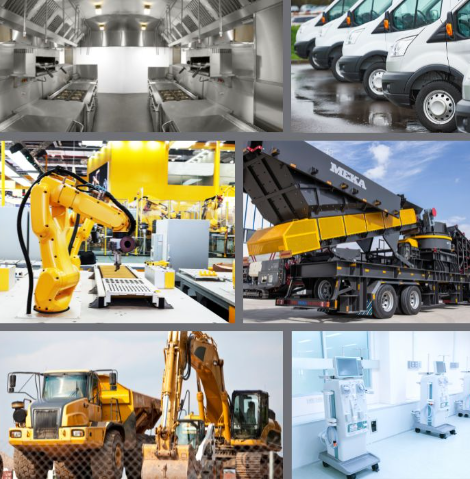

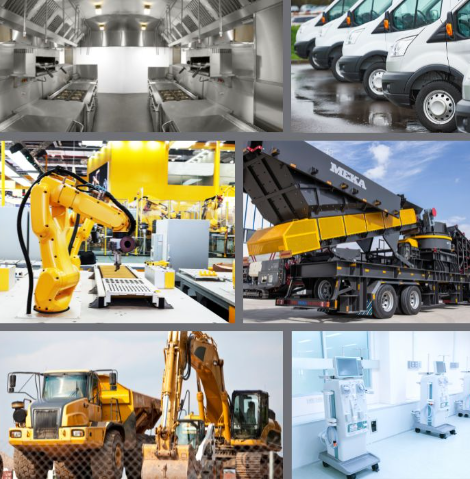

We can provide asset finance for both ‘soft' and ‘hard’ assets, such as; Machinery, equipment, vehicles, hardware, IT hardware, renovations, POS systems, catering equipment, tools, and much more.

Speak to an Advisor Now

Flexible

Asset finance can be unique to every business which is why we offer a personal touch.

Trusted

We have 30 years of experience in asset finance and you can trust us to get the process right.

Open Minded

We go the extra mile and understand that sometimes you have to be creative to find the right solution.

Smart

Apply online and receive the fastest updates about your application with a personal touch.

How Asset Finance Works

Step 1

Identify what you want to buy

Step 2

Speak to a personal advisor

Step 3

Secure the best rate

Step 4

Receive the funding

Commercial asset finance enables a business to buy assets without the upfront costs. We only advise on non-regulated funding solutions.

What is Asset Finance?

Asset finance allows your business to purchase assets you need for growth and spread the costs over flexible terms with affordable monthly repayments. This has the added benefit of improving cash flow.

Using commercial asset finance, a company can purchase equipment, buy vehicles or invest in commercial property, enabling them to expand or keep up with the market.

What is Asset Finance?

Asset finance allows your business to purchase assets you need for growth and spread the costs over flexible terms with affordable monthly repayments. This has the added benefit of improving cash flow.

Using commercial asset finance, a company can purchase equipment, buy vehicles or invest in commercial property, enabling them to expand or keep up with the market.

Benefits of Asset Finance

- Purchase what you need now

- Invest in new machinery or equipment

- Preserve other available finance options

- Spread costs over a short or long-term period

- Potential tax advantages available

- Boost liquid capital in business

- Protect your personal wealth

- Secure fixed competitive rates

FAQ´s Asset Finance

Can´t find the answer to your question below? Please send us a message.

-

What can I buy with asset finance?

-

How much does asset finance cost?

The costs of asset finance can be different for every business. The factors we take into consideration are based on your individual circumstances, credit history, business performance, and the type of asset purchase you want to make will all affect the rate we can help you get.

-

How long will I be paying back the finance?

Asset finance terms can be short or long-term. Available for up to 6 years. The options available to you would be dependent on the individual circumstances of your business or the type of asset you are purchasing, but then the final decision is up to you on how long the terms will last.

-

The amount that you are able to borrow depends on many variables such as how long you have been trading. Our customers often obtain asset finance for amounts between £10,000 and £2,000,000.

The amount that you are able to borrow depends on many variables such as how long you have been trading. Our customers often obtain asset finance for amounts between £10,000 and £2,000,000.

-

Do you provide asset finance outside of the UK?

Cavendish Capital can only provide asset finance inside the United Kingdom.

Ready to talk?

We know that asset finance can sometimes be confusing and stressful, but what we do is make it simple. Speak to an advisor today to learn more about your finance options.

All the rates mentioned on this page are subject to your individual circumstances. In some instances, we can even offer better rates and more diverse solutions. Message us to receive a free consultation with a Finance Expert in your field.

What our clients say

The team at Cavendish Capital is knowledgeable, hardworking, and honest. Highly recommended.

Our dental clinic was quickly able to secure asset finance that increased our treatment capacity.

We received a 5-star service from Cavendish Capital when asset financing a new fleet of vans.

We needed a new forklift. Cavendish Capital were able to get us the finance immediately.